-

Loan pre-approval in 7 working hours*

-

RAA members save

-

Flexible payment terms

-

No monthly fees

Apply for a fixed rate car loan with flexible repayment options

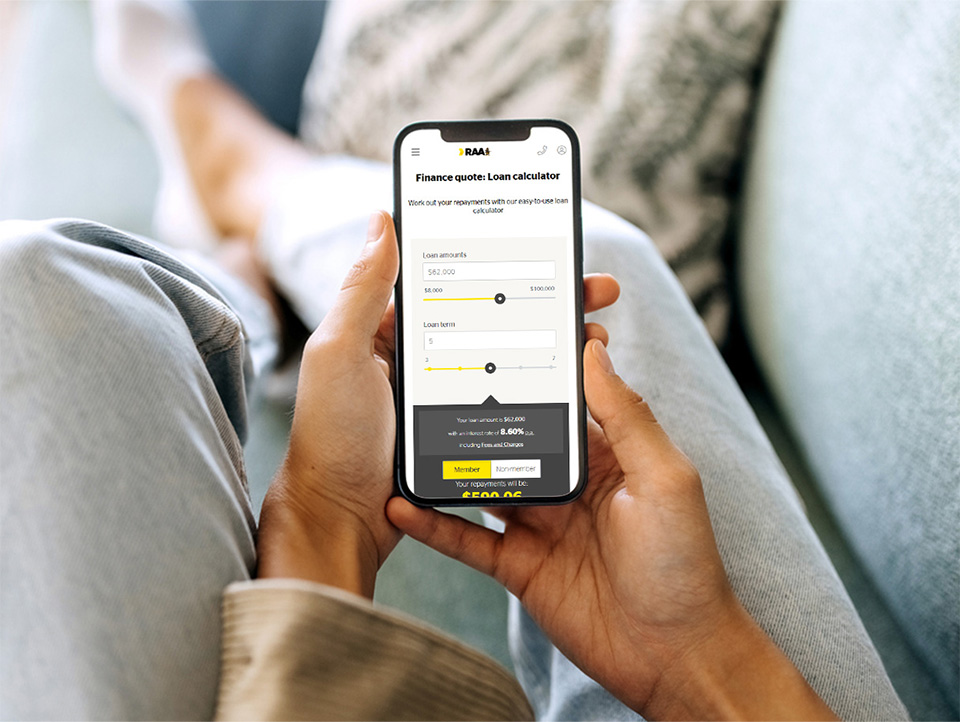

Whether you’re buying your first car, or upgrading your vehicle, an RAA car loan can get you on the road sooner. With car financing from $8,000 to $150,000, we can help you drive through Adelaide in style. We also offer personal loans for caravans and financing for other vehicles like boats, motorbikes and jet skis, so you can pick the ride of your dreams.

Applying online is quick and easy, with loan pre-approval within 7 working hours*.

Interest rates

Enjoy competitive interest rates and no monthly fees with RAA Finance.

Plus, if you're an RAA member, you'll save 1% p.a. on the standard interest rate, plus $100 off the loan establishment fee.

| Loan amount | $8,000 - $24,999 |

$25,000 - $34,999 | $35,000 - $54,999 | $55,000+ |

| Member interest rate | 11.25% p.a. | 8.80% p.a. | 8.10% p.a. | 8.10% p.a. |

| Member comparison rate^ | 11.70% p.a. | 9.24% p.a. | 8.53% p.a. | 8.53% p.a. |

| Non-member interest rate | 12.25% p.a. | 9.80% p.a. | 9.10% p.a. | 9.10% p.a. |

| Non-member comparison rate^ | 12.85% p.a. | 10.38% p.a. | 9.68% p.a. | 9.68% p.a. |

^Comparison rates are based on a $30,000 personal secured loan for a 5 year term. The comparison rates are true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate. Please check the loan terms and conditions (PDF, 600KB).

There are no monthly account-keeping fees with RAA Finance. A one-off establishment fee of $299 for RAA members and $399 for non-members, plus an $8.00 Personal Properties Securities Registration (PPSR) fee may apply. An early termination fee of $225 may apply if a loan is paid out in the first 24 months.

How do I apply?

-

Check your eligibility

You need to be:

At least 18 years old

An Australian citizen or permanent resident

Living in SA or Broken Hill

Earning a regular income

-

Gather your documents

You need to have:

Proof of identity

Residential and employment details for the last two years

Financial details including income, assets, expenses and liabilities

-

Submit an application

Apply online or call us on 8202 8331.

We'll let you know the outcome of your application within 7 working hours.* -

We'll be in touch

If your application is successful, we’ll ask you for some documents and have you sign some of ours.

We’ll arrange an EFT transfer.

Why choose RAA Finance?

-

Pre-approval within 7 working hours*

Achieve your dreams faster, with loan pre-approval within 7 working hours.* -

Borrow from $8,000 up to $150,000

Need a new car? You can borrow from $8,000 up to $150,000. -

Flexible repayment terms

Choose fortnightly or monthly repayments, and a term between 3 and 7 years.

-

Competitive fixed interest rates

With our competitive fixed interest rates, you'll know exactly how much your repayments are for the full term of the loan. -

No monthly fees

With no monthly fees you’ll save even more. -

RAA members save

RAA members save 1% p.a. on the standard interest rate, plus $100 off the loan establishment fee.

Frequently asked questions

-

What fees and charges are there?

There are no monthly account-keeping fees.

Before you start your loan term, you'll need to pay:

- Establishment fee: $299 (RAA members), or $399 (non-members)

- Personal Properties Securities Registration (PPSR) fee: $8

The PPSR is to check that the car you're buying is debt-free, safe from repossession, not written off and not reported stolen.

If you choose to repay your loan in the first two years, you'll pay an early termination fee of $225.

We're here to help

-

Call us

Monday to Friday, 9am to 5pm -

Enquire online

Send us a message and we'll contact you -

Find a shop

Drop in and chat face-to-face -

Frequently asked questions

Visit our Help Centre for answers to FAQs, key documents and more

Things you should know

*Subject to applicants satisfying all conditions. Limited lending criteria. Fees and charges are payable. If the conditions of your loan have been met, the loan contract will be available for signing the following business day and the funds will be processed either via BPAY or EFT 24-48 hours from settlement.

When deciding to purchase or hold an RAA Finance loan, consider the RAA Finance loan terms and conditions (PDF, 1013KB) and Target Market Determination.

RAA Finance loans are provided by RAC Finance Limited ABN 77 009 066 862 Australian Credit Licence 387972 and are subject to RAC Finance lending criteria; conditions, fees and charges apply. Royal Automobile Association of South Australia Limited ACN 677 371 274 credit representative number 466848 is an authorised representative of RAC Finance Limited.

If you have any queries regarding your existing loan with Royal Automobile Association of South Australia Limited ACN 677 371 274, trading as RAA Finance, please call 1300 651 812 or email finance@raa.com.au.